From examining your credit history to reviewing home mortgage offers from lenders, here are tips to help you get the best home mortgage.

The Top Line

- The home mortgage that you select is an important financial decision that can have ramifications in the form of years of paying on your mortgage and several thousand dollars paid in interest.

- There are a variety of factors to take into consideration when finding the best home mortgage.

- The best home mortgage for someone else might not necessarily be the right option for you. The best home mortgage for you depends on your unique situation, budget, and needs.

- There are thousands of providers of home mortgages in the country. Always weigh your options.

If you are looking to buy a home in the near future, then you may be wondering about potential strategies to get the best home mortgage. Getting a home mortgage can sometimes be a complicated process that seems difficult, but the truth is that there are some very simple tips that you can utilize if you want to know how to get the best home mortgage. With the tips and knowledge provided in this guide, you’ll be sure to be in a great position to get the best home mortgage for your needs.

Boost Your Credit Score When Possible

When you’re applying for a home mortgage or any other loan, for that matter, your credit score is going to play a very large role not only in whether you are approved, but in the quality of the offer that you receive when it comes to the down payment and interest rate. If you want the best possible deal for your home mortgage and to get a mortgage that fits your needs, you should do everything you can to boost your credit score.

Your credit score is a record of your past borrowing, so there are times when it will be difficult to raise your credit score. However, there are some things that you can do to help your credit score quickly. These include paying any delinquent or overdue accounts, disputing any inaccuracies, and not closing old accounts (age of credit helps your credit score). See more tips in our article Building Credit 101.

Before you apply for a home mortgage, it's best that you try to spruce up your credit score in any way possible. With these simple steps, you could make a huge impact on the odds of approval and the interest rate that you're able to achieve for your home mortgage.

Save Up for a High Down Payment

One of the best things that you can do to improve your situation when you are preparing to apply for a home mortgage is to save up for as high of a down payment as you can afford. A high down payment will lower your total loan amount, which means that you can often achieve either a shorter term or a lower interest rate. At the very least, you will decrease the amount that you pay in interest over the long-term since less of the total purchase amount will be financed and accruing interest.

A standard down payment is around 10% for a first-time home buyer and ranges to about 20% for someone on their second or third home. In addition to providing you with some financial benefits over the term of the loan, a higher down payment can also attract better financial institutions that have better lending options and account solutions. This can also mean that you get a better deal when it comes to the terms of your deal.

Finally, there is a benefit in saving for a higher down payment if you are able to make a down payment of 20% or higher. This is because for any mortgage lower than 20%, mortgage insurance is required. This adds an additional cost on the top of your home, making it more expensive to pay your mortgage each month.

Maintain or Increase Income

When you are applying for a home mortgage, the best options will present themselves if you work to make your application as attractive as possible. One of the many ways to do that is to maintain or increase your income. When the lender sees that you have a stable or increasing income, they will be much more easily persuaded to approve you for a home loan.

Banks and lenders want to know that you are going to be able to pay back the loan that they give you. For that reason, they look into your income and analyze your ability to keep up with the mortgage payments. Increasing your income can certainly increase your chances of approval and allow you to afford a larger house, should you want one.

Consider a Shorter Term

If your goal is to pay as little interest as possible and pay off your home sooner, then getting a shorter-term loan might be the right option for you. Home mortgages are generally offered in 30-year and 15-year terms. Loans with a 30-year term might provide you with cheaper home payments every month, but what they don't provide is the best option for anyone who is hoping to save money by paying less interest over the life of their loan. In addition, interest rates for 15-year loans are generally lower than for 30-year loans.

Considering a shorter-term loan might increase your monthly payment, but it could certainly make your home more affordable in the long-run. A shorter-term loan should definitely be on your radar if you are hoping to get the best possible deal for your home mortgage.

Take Advantage of First-Time Homebuyer Incentives

One of the best things that you can do to help yourself in the home buying process if you are a first-time homebuyer is to inquire about the various benefits that are available to first-time homebuyers. First-time homebuyers are eligible for many benefits that provide a more affordable, easier home buying process. These include federal programs that allow you to make a smaller down payment as well as local and regional programs that incentivize you with lower interest rates to entice you to stay in the area for longer.

The best way to do this is to speak with a lender that knows these benefits well. They will be able to determine your eligibility and provide you with the guidance that you need to take advantage of these programs. There are plenty of first-time homebuyer programs that you can use to achieve your home buying goals and ensure that you get the best home mortgage.

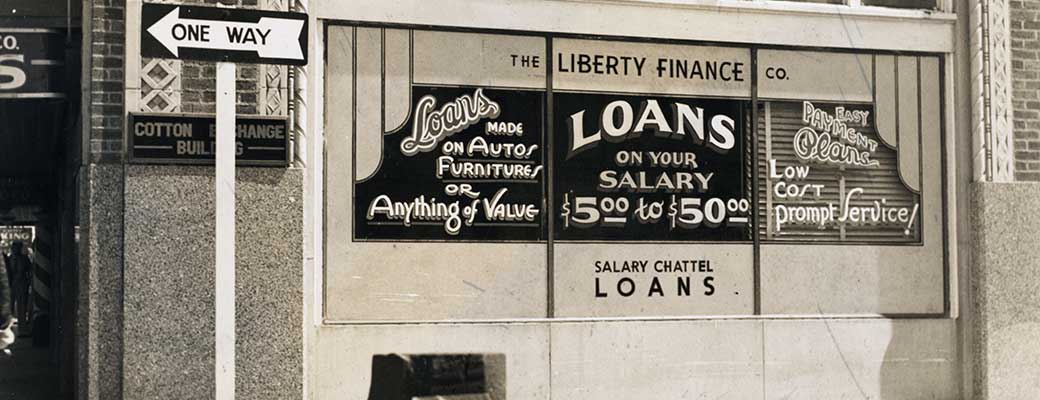

Weigh All the Options

Just like you would when shopping for vehicles or other large purchases, you should always ensure that you are taking the time that you need to make the best decision. Rushing the decision can only lead to an outcome wherein you do not make the choice that is best for you.

There are hundreds of institutions out there that are able to provide home mortgages. You should not just settle for the first one that comes along. If you have the luxury of time, be sure to check the other home lending options out there to compare rates, benefits, customer service, online access, and other things that could lead to you getting the best home mortgage.

CASHTELLIGENT RECOMMENDED thumb_up